Research Project: Strategic Briefing On The Management Finance Policy Decsion-Making For Fortescue Metals Group Limited

Question

Task: Your current role is the Manager of the Finance Division of Fortescue Metals Group Limited, and you report directly to the Chief Financial Officer (CFO) of the company. The CFO has requested you to attend a strategic retreat being held by the company to present to the Senior Leadership Group, including the Chief Executive Officer (CEO) and the Board of Directors, on the current financial policy platform of the company, the nature of the linkage or association between these policies adopted by the company, and how they integrate to influence the operating and share performance outcomes for Fortescue Metals Group Limited.

Fortescue Metals Group Limited (FMG) is a leading iron ore production and exploration company which operates in the Pilbara region of northern Western Australia. The company is the fourth-largest listed resources company in Australia, behind BHP Billiton Limited, Rio Tin to Limited and Woodside Petroleum Limited, and the largest pure-play iron ore mining company listed in Australia. The company currently has two primary production sites in operation, namely the Chichester Hub located in the Chichester Ranges in the Pilbara region comprising the Cloudbreak and Christmas Creek mining projects, and the Solomon Hub, which is located 120 kilometers west of the Chichester Hub and comprises the Firetail and Kings Valley mines. The company’s current operational objective is to achieve iron ore production of at least 155 million tonnes per annum (Mtpa), and it has undertaken an aggressive expansion program in the last decade in pursuit of this objective. The iron ore produced by the company’s mining operations is transported to their port facilities at Port Hedland and is shipped for spot market or futures contract trading in a number of overseas locations, but predominantly China.

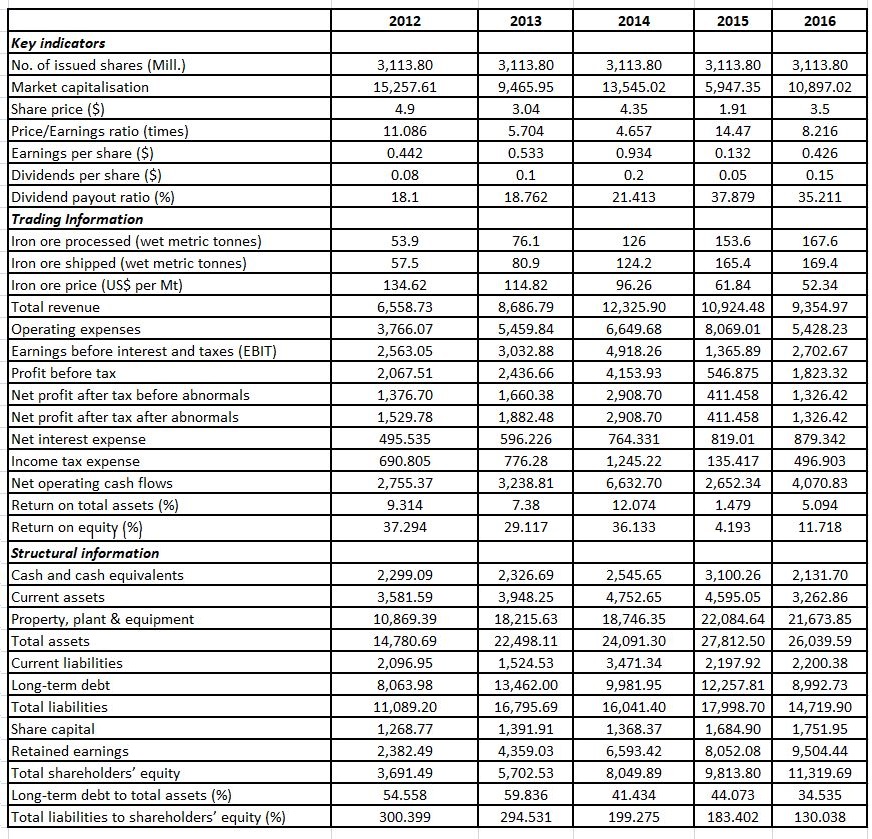

The following table provides a summary of financial and structural information for Fortescue Metals Group Limited for their recent June 30th year ends (All figures, except for per share, issued capital, and percentage statistics, are expressed in A$Million):

Further detailed overall summary, structure, financing, and performance information can be obtained from the 2016 Annual Report document for Fortescue Metals Group Limited, which is available from the subject LMS site. Prior year annual report documents and other filings and announcement information relating to the company can be obtained from the Fortescue Metals Group Limited website (www.fmgl.com.au) or from the DatAnalysis Premium database available through the Databases link on the University Library website. Other relevant information relating to Fortescue Metals Group Limited or the wider corporate sector is as follows:

- Assume this analysis is being undertaken as at Monday 10th July 2017

- Fortescue Metals Group Limited’s share price on Monday 10th July 2017 is $5.09 per share, and there are3,113.798 million issued ordinary shares on this date.

- Fortescue Metals Group Limited is part of the Materials Sector based on the Global Industry Classification Standards(GICS), and its GICS Industry is Metals and Mining.

- Fortescue Metals Group Limited’s beta coefficient on July 10th, 2017 is 0.89, compared to the beta coefficient for the overall industry of1.04.

Required:

The CFO has requested you to submit two documents in preparation for the strategic retreat

- A Background Briefing Report providing detailed explanation of the required content.

The documents, prepared employing information from the annual report documentation and any other documentation or sources of information considered to be relevant, are required to identify and outline the following aspects of Fortescue Metals Group Limited’s management finance policies:

- The nature of the firm’s working capital management policies. Focus in this determination should be on overall current asset investment and financing policies, rather than the company’s adoption of policies relating to specific current asset categories, such as inventories or receivables.

- The nature of the firm’s capital structure determination policy, including identification of specific policy adoption or usage if relevant, whether the firm appears to have target or optimal capital structure ratios, and the determinants of the firm’s capital structure choice.

- The nature of the firm’s earnings distribution and dividend payout policies. This should include discussion of the type of dividend policy employed, whether the firm has a target dividend policy or payout ratio, changes in dividend payout amounts or patterns, and the consideration of taxation, dividend imputation and franking credit issues and any other relevant elements associated with the firm’s overall earnings management and distribution practices.

- The nature of the firm’s corporate governance structure, and particularly the board, committee, and key decision-making structures and mechanisms in place, and any changes in this corporate governance structure in recent years.

- The nature of any association or relationship between these various financial management policies employed by the firm, and how this may relate to Fortescue Metals Group Limited’sshareand/or accounting performance outcomes.

Answer

Executive Summary: The working capital of a firm determines its operations and success. Hence, the working capital of the firm needs to be managed in an effective manner and the management needs to stress on this factor. Along with the working capital, the company needs to project on the concept of capital management, capital structure, and the risk management strategy. It is imperative that all must happen in a coordinated manner to ensure a smooth functioning. In the report, Fortescue Metals Group Limited (FMG) is considered and studied for preparing the report. The financial policies, working capital, dividend policies, etc are studied in the light of Fortescue Metals Group.

1. Ascertainment of financial policies and working capital investment undertaken by the company

Working capital is calculated by deducting current liabilities from the current assets of a company. Moreover, a company requires more of its current assets to carry out a smooth flow of operations by addressing all its obligations. Further, the ratio of working capital is also the same as a current ratio that sheds light on the company’s capability in discharging its debt obligations. Based on the report of Fortescue, it can be seen that the company has a working capital of more than one throughout the five-year period that shows effective short-term liquidity on the part of the company. Nevertheless, the company’s current assets have witnessed an increasing trend until the year 2015 portraying an expansion in the company’s affairs. However, the current liabilities witnessed both increasing and decreasing trend throughout this five-year period.

The company’s working capital ratio is under huge mess when an enormous value gets blocked in the segment of inventories. The reason behind this can be attributed to the fact that such stocks must be sold off to dispose or discharge all the obligations (Choi & Meek, 2011).

Hence, the quick ratio has been calculated and such ratio reflects that a quick ratio of more than 1:1 is the standard rate. Moreover, in all the five-year tenure apart from 2014, the quick ratio remains at more than 1:1 reflecting that the organization’s one dollar of current assets for every one dollar of current liabilities is intact in nature (Fortescue Metals Group, 2016).

In relation to Fortescue Ltd, the working capital can be regarded as stagnant in nature. This sheds light on the fact that the company has been able to maintain its level of current assets and liabilities at a moderate phase. Furthermore, such working capital has remained more than one throughout the period of five years ensuring that the company is safeguarded from the danger of obstruction of the smooth flow of operations (Fortescue Metals Group, 2016). The capital investment and management policy further signify enhanced utilization of resources to address the debt obligations in future. Overall, the company’s strategy remains conservative in nature as it has more cash resources to address its obligations in the upcoming tenure.

2. Ascertainment of capital structure measure that is adopted by the company

Fortescue’s size is enormous in nature as it resources have reported an amount of A$10897.02 billion that facilitates in the attraction of investors and creditors, thereby facilitating in enhancing its reputation as well. In consideration of the last five-year period, it can be said that the company’s overall reliance on debt has reduced. Besides, such debts have declined from $12257.81 to $8992.73 that signifies addressing of debt obligations effectively. This also sheds light on the fact that paying off debt obligations will provide operating cash in the hands of the company that is free from future obligations (Fortescue Metals Group, 2016).

Nonetheless, the company’s capital structure can be ascertained with its debt-equity ratio. The component of debt and equity of the company projects that the company had previously emphasized debt capital structure to carry out its operations. However, it must be noted that a higher debt-equity ratio is not a favorable position for any company as it signifies huge obligations that are altogether a negative indicator for the shareholders (Vaitilingam, 2010). In simple words, such high reliance on debt structure is a massive risk for the company. Moreover, based on the numbers, in the current scenario, both total liabilities and long-term debt have significantly declined but still, the debt-equity ratio has remained more than 0.5 stating that Fortescue must square of its debts to pursue a balanced ratio (Volcker, 2011). Nevertheless, it must also be noted that since Fortescue is a bigger company and it can easily manage its payments to carry out its overall state of affairs.

In relation to Fortescue, it must be taken into consideration that the company’s net revenue has enhanced throughout the period but it has also witnessed a decline in the year 2016. Moreover, the net profit of the company also witnessed an increasing trend and the reason behind such enhancement can be attributed to its enormous sales and production measures (Fortescue Metals Group, 2016). Besides, when there was a fall in the level of debt within the company, it can be seen that the net profit subsequently witnessed a major increment (Christensen, 2011). Overall, since Fortescue Ltd has been an enormous organization, it possesses a benefit in relation to a small cap in a way that its cost of capital is lesser due to the measures of cheap financing undertaken by it. Nonetheless, the size of the company is bigger in nature and hence, it can easily pave a path for itself to cover its interest payments, thereby shedding light on the fact that the company’s state of affairs is effective in nature ((Burke et. al, 2010).

In relation to the previously mentioned statement, it can be commented that companies with much of resources often possess an advantage over companies with small market capitalization. The reason behind this can be attributed to the fact that such large companies can easily attain benefits through lower costs of capital owing to cheaper sources of finances (Wagenhofer, 2014). This means that even though the debt structure of the company is higher in nature if it pursues an ability to cover its entire payment of interests, it can be regarded as an efficient and benevolent organization that can utilize its additional leverage possibility to sustain in the industry (Scapens, 2012).

3.Determination of the earnings distribution and dividend policy employed by the firm

The earnings distribution and dividend policy can be commented with the help of dividend and dividend payout ratio. As per the information, it is noted that the dividend payout ratio has an uptrend in 2013 and 2014 meaning that the company provided a dividend in every year. However, in the year 2015, the net income declined to lead to a drop in the dividend factor. This means that the dividend is directly related to the net income of the company. When the profit scenario of the company is good, the dividend payout is strong (Arnold, 2010). Further, from the financial statement, it is observed that the business showcased the high growth and thereby the dividend payout is strong (Fields, 2011). This indicates that the future prospect of the company is high and the investors can select this company.

The system of tax imputation was proposed by Australia in the year 1987 and impacts the dividend policy of Australian companies. The major benefit resides in the fact that double taxation on the dividend on income can be removed. The shareholders of Fortescue will have a major benefit because of after-tax net and franking credit. In the year 2016, the dividend per share of the company was $0.07 and the number of shares that were issued was 3113.80. Hence, the overall dividend that was paid by the company amounted to $217.966 ($0.07x3113.8). As per the trend of the company in terms of share price, it can be seen that the net income of the company increased while the dividend declined in 2016. The share price did not project a higher volatility because the debt level kept on increasing, as well as decreasing owing to the addition and squaring up of debts. Such factors are a clear-cut indication of the fact that the variation is directly associated with the global scenario and the performance of the product line (Ferris et. al, 2010). Fortescue has immense stability and as peer the performance it can be stated that the company will continue its formidable run in the coming future.

4. Determination of the corporate governance structure and policies employed by the firm

A detailed description of the policy to be employed and also defining the corporate structure governance- for having a long-term success it is very important for Fortescue to have good corporate governance. Not only the boards but also the management level people are giving efforts to attain the company mission and vision (Parrino et. al, 2012). The company has a formal corporate governance as it follows the requirements which are specified under ASX corporate governance principles and recommendations. From this, it can be summarized that integrity, transparency, stewardship and corporate accountability are regularly followed by the company. In the company a subcommittee is there whose work is to see whether policies and procedures comply. The subcommittee includes remuneration and nomination committee, audit and risk management committee, audit and risk management committee and finance committee. In order to develop shareholder interest, the board is combined with executive and non-executive director both. With the help of such corporate governance, Fortescue attains capital projects, international experiences, sales and marketing, and infrastructure, resources, and mining experience. In order to address the shareholder skill and experience of directors are also important. The company selects the candidate without discriminating them according to gender, race, age, physical capabilities, etc.

The Board keeps a strict eye on the senior post executives. Many matters like ownership structure, significant affairs and involvement in the international market have seen corporate governance structure’s domination. The company has caught hold of qualms which have had an impact on the company and this is possible because of the positiveness of the corporate governance structure. The top rule for a formal industry is to check the ideas that the company has been planning to undertake. Changes in Board composition had first maintained that there are many independent directors in 2017 but is now ruling that their majority is lesser than expected. Even though such changes have been made, the Board is satisfied that their directors exercise sovereign judgment for the interests of stakeholders respectively.

5. Associations and relationships between the various management policies employed by the firm

The Fortescue Company has summoned up different management policies that have made the company a very competitive one in the entire market. The company has been providing dividends to its shareholders over the last five years which shows that the company has been following a well-maintained dividend policy. This can be said on the basis of the data accumulated and analyzed over the years. Another data shows that the company has been continuously providing a rise in the amount of dividend paid each year. The working capital management of the company can be related to the payment of such high dividends that show that over the years, the company has been successful because of which the liabilities have been decreased and the profit margins have increased. In simple words, the liabilities and dividends have shown an inversely proportional relationship towards each other (Damodaran, 2010). It would not be wrong to say that according to the dividends paid, the debt over the company has also been decreased. Furthermore, it can be observed from the annual report of the company that it has a relaxed fat cat policy for the year 2013 and 2014 together with a conservative policy stance wherein long-term sources of finance have been majorly used to finance permanent current assets, fixed assets, and few temporary current assets (Fortescue Metals Group, 2016).

Huge debts have been bothering the company over the years and capital structure is shown more importance and dependence rather than opting for equity financing (Gibson, 2012). It was in the year 2014 that the company saw an increase in its profits as compared to the year 2012, but this profit level has again been reduced to low in the year 2015 and 2016 after paying the tax in all the years. This data is enough to say that the plan that the company has been executing for the past years had a negative impact on the profits which only increased the liabilities of the company and has whacked the profits on a set back after the tax deduction. Accumulation of the retained earning has been at the top of the to-do-list for the company which has been a fool in utilizing its debts to gain assets as seen for the previous years (Carmichael & Graham, 2012). It is advised that the company must eliminate or suppress the use of debt financing and encourage equity financing so that the interest payment that has accumulated to a huge chunk over the year can be controlled effectively and thus enhancing dividend paid and net income (Ferris et. al, 2010).

The summary shows that the portfolio policy of the company is risky in nature and because of that; debt funding has been the major support to execute the tasks which it has been planning. Financial management policies of the company show such signs which make it clear that that the corporate governance structure gives a welcomed entry to threat struck ventures. So all the point mentioned above has caused the performance of the company to get deviated on a large scale.

References

Arnold, G 2010, The Financial Times Guide to Investing, Prentice Hall.

Burke, A., Van, S. A., & Thurik, R 2010, ‘Blue ocean vs. five forces’, Harvard Business Review, vol. 88, no. 5, pp. 28-29.

Carmichael, D.R. & Graham, L 2012, Accountants Handbook, Financial Accounting and General Topics, John Wiley & Sons.

Choi, R.D. & Meek, G.K 2011, International accounting, Pearson .

Christensen, J 2011, ‘Good analytical research’, European Accounting Review, vol. 20, no. 1, pp. 23-32

Damodaran, A 2010, Applied Corporate Finance: A User’s Manual, New York: John Wiley & Sons

Ferris, S.P., Noronha, G. & Unlu, E 2010, ‘The more, merrier: an international analysis of the frequency of dividend payment’, Journal of Business Finance and Accounting, vol. 37, no. 1, pp. 148–70.

Fields, E 2011, The essentials of finance and accounting for nonfinancial managers, New York: American Management Association.

Fortescue Metals Group 2016. Fortescue Metal Group Annual report and accounts 2016. [Online] Available at: https://www.fmgl.com.au/ [Accessed 25 April 2017].

Gibson, C 2012, Financial statement analysis, Mason, Ohio: South-Western.

Parrino, R., Kidwell, D. & Bates, T 2012, Fundamentals of corporate finance, Hoboken, NJ: Wiley

Scapens, R.W 2012, Commentary: How important is practice-relevant management accounting research? Qualitative Research in Accounting & Management, vol. 9, no.3, pp. 293 – 295.

University Press

Vaitilingam, R 2010, The Financial Times Guide to Using the Financial Pages, London: FT Prentice Hall.

Volcker, P 2011, Financial Reform: Unfinished Business, New York Review of Books.

Wagenhofer, A 2014, The role of revenue recognition in performance reporting, Oxford University Press

Appendix

Ratio

|

Working capital |

2012 |

2013 |

2014 |

2015 |

2016 |

|

Current Assets |

3,581.59 |

3,948.25 |

4,752.65 |

4,595.05 |

3,262.86 |

|

Current liabilities |

2,096.95 |

1,524.53 |

3,471.34 |

2,197.92 |

2,200.38 |

|

Working capital = |

1,484.64 |

2,423.72 |

1,281.32 |

2,397.14 |

1,062.48 |

|

Particulars |

2012 |

2013 |

2014 |

2015 |

2016 |

|

Current Assets |

3,581.59 |

3,948.25 |

4,752.65 |

4,595.05 |

3,262.86 |

|

Current liabilities |

2,096.95 |

1,524.53 |

3,471.34 |

2,197.92 |

2,200.38 |

|

Current ratio |

1.708002 |

2.589817 |

1.369113 |

2.090639 |

1.482864 |

|

|

|

|

|

|

|

|

Particulars |

2012 |

2013 |

2014 |

2015 |

2016 |

|

Current Assets |

3,581.59 |

3,948.25 |

4,752.65 |

4,595.05 |

3,262.86 |

|

Inventory |

617 |

1036 |

1557 |

1007 |

746 |

|

CA- inventory |

2,965 |

2,912 |

3,196 |

3,588 |

2,517 |

|

Current liabilities |

2,096.95 |

1,524.53 |

3,471.34 |

2,197.92 |

2,200.38 |

|

Quick Ratio = |

1.413765 |

1.910262 |

0.920583 |

1.632478 |

1.143831 |

|

|

2012 |

2013 |

2014 |

2015 |

2016 |

|

|

|

|

|

|

|

|

Total equity |

3,691.49 |

5,702.53 |

8,049.89 |

9,813.80 |

11,319.69 |

|

Total debt |

11,089.20 |

16,795.69 |

16,041.40 |

17,998.70 |

14,719.90 |

|

Debt equity ratio= |

0.3328909 |

0.3395232 |

0.5018199 |

0.5452506 |

0.7690056 |

|

|

2012 |

2013 |

2014 |

2015 |

2016 |

|

Div |

0.11 |

0.06 |

0.29 |

0.19 |

0.07 |

|

Div payout ratio |

0.49 |

0.6 |

0.93 |

0.13 |

0.43 |