Financial Planning Assignment: Development Of A Client's Financial Plan

Question

Task:

Your task is to write a financial planning assignment addressing the following parts:

Part 1

The assignment is based on material covered in weeks 2 to 9, however will involve reviewing course materials for week 10 and 12. You will be required to complete a detailed file note (1500 words) as preparation for development of a client's financial plan (Statement of Advice).

Students are provided with a transcript summary from an initial meeting between a financial planner and new clients. Based on this transcript, students will be required:

- to provide an overview of the client's circumstances (including their current situation and goals, tables of financial position) and provide potential wealth creation, wealth protection (insurance) and lifestyle strategies that address these circumstances and goals,

- to provide a list of assumptions you are making; and

- prepare a list of questions for the clients where further information may be required prior to completing the SoA.

Summary of transcript

Date to use for initial contact: 1 August 2020

Emily and Joel Stevens

Emily and Joel realise that they are not getting anywhere financially. They have decided it is time to bite the bullet and get their finances in order. They believe that a first glance, their finances seem good, but there are a number of issues that need to be resolved.

Emily earns $81,000 p.a. Her employer contributes the 9.5% Super Guarantee. She has not been contributing herself and at age 41, her balance is around $125,000 – she is aware that this is not a good outcome.

Joel, age 45, earns $122,000, and like Emily he has not been putting any extra into his super. His current balance is $156,000. They would like to retire when Emily turns 60 and believe they will need $49,000 in today’s dollars to live on.

They have an emergency savings account of $25,000 earning 0.5%. They also have a share portfolio currently worth $250,000 and $150,000 as a margin loan. The interest rate is 8% and the portfolio earns 3.0%. They are uncertain about this investment and see the interest payments eating up all of the earnings. It is also of concern how to fund university costs for their children Lauren who is 10 and Michael who is 8.

Several years ago, they inherited a rental property valued at $450,000. It is now worth around $570,000 but is only returning 4% - which after associated fees and charges ($4,280 per year) is actually lower. They are not that happy with the property but would hold onto it if it was financially suitable.

However, with the shares and the property, they are wondering if they are burdening themselves unnecessarily. They find it all confusing, time consuming and seemingly not very rewarding. On top of it all, they have to pay their accountant $1,800 a year to sort it all out. On the whole, they feel they earn a lot of money and never have an extra dollar to their name.

Emily and Joel feel ‘exasperated’. And the expenses!

Aside from paying the deductible expenses, they find they are spending a lot of money, and their credit card balance seems to get bigger each month.

Their mortgage balance on their on their home is $235,000, they have thought of refinancing.

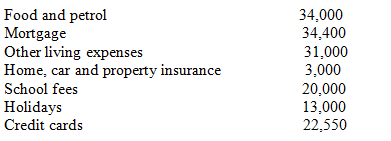

When asked to itemise their expenses, they provided the following calculations:

They estimate their credit card balance is around $55,000 at approximately 17.75%

As for personal insurance, neither have income protection or trauma cover. Emily has $34,000 in life and TPD in her super and Joel has $64,000 life and TPD. Emily cannot get higher cover in her fund as the cover is standard. Joel can purchase up to three (3) times his salary. They are concerned about their budget if personal insurance is needed.

Part 2

A successful client meeting involves preparation, well-honed interpersonal skills and adherence to compliance procedures. All of this may come naturally to some advisers. However, for most, conducting a successful fact finding meeting is a skill that will be acquired and developed over time.(1000 words)

Required

- Discuss how to prepare for a successful fact finding meeting.

- Explain the legal basis for using a fact find document.

- Outline the elements of a successful fact finding meeting.

Answer

The Profile of Advisor and FSG

As per the case considered in this financial planning assignment, Joel and Emily Stevens were significantly handed with the Financial Services Guide (FSG) version 10, andthe interview was conducted on 1 August 2020, where I was the Advisor Profile. In significantly provided them with a proper guide towards their financial issues and saving. Moreover, the Corporations Act and Section 961 was duly taken into effective consideration for this advice. Using these aspects, the FSG was duly explained to the couple.

The Overall Scope of Advice

The Full Statement of Advice (SOA) tends to provide effective advice concerning the various ways through which there can be an effective creation of wealth, and the goals in the lifestyle can be met in a significant manner. Moreover, it also provides effective factors through which substantial protection towards the income, as well as the trauma, can be maintained among the clients who seek advice regarding their financial position. It allows the client to achieve prominent protection towards their finance as well as allows in creating wealth for future safety.

However, in this SOA, the overall analysis of the cash flow, as well as the interpretation using budgeting, has not been taken into consideration and are completely excluded from this part. Moreover, the planning concerning social security as the repayment of the loans and debt are also not evaluated in this SOA. Proper recommendations towards their expenses and the risk that they can face in the future concerning their financial position are stated in a significant manner.

The Present Situation of the Clients

|

Your personal profile |

Emily Stevens |

|

Birth Date |

11/02/1979 |

|

Present Age |

41 |

|

Status of Marriage |

Married |

|

Residency Status |

Mortgaged Home |

|

Residential address |

N/A |

|

Telephone |

N/A |

|

Email address |

N/A |

|

Employment status |

Full time employed |

|

|

|

|

Your personal profile |

Joel Stevens |

|

Date of birth |

11/02/1975 |

|

Current age |

45 |

|

Marital status |

Married |

|

Residency Status |

Mortgaged Home |

|

Residential address |

N/A |

|

Telephone |

N/A |

|

Email address |

N/A |

|

Employment status |

Full time employed |

|

Dependents |

Current age & date of birth |

|

Lauren |

Ten years old 16/12/2010 |

|

Michael |

Eightyears old 12/01/2012 |

|

Your health |

|

|

Current health |

Completely Healthy |

|

Pre-existing medical conditions? |

No |

|

Member private health fund |

No |

|

Smoker? |

No |

|

Family history considerations? |

No data provided concerning family history |

|

Lifestyle Assets |

Value |

|

Includes houses, vehicles, etc. |

|

|

Inherited Property from Rent (4 per cent return) |

$570,000 |

|

|

|

|

Subtotal |

$570,000 |

|

Financial Assets – Non-Super |

Value |

|

e.g., shares, bank accounts, managed funds,rental property, etc. |

|

|

Margin Loan |

$150,000 |

|

Shares |

$250,000 |

|

Subtotal |

$ 400,000 |

|

Financial Assets – Super |

Value |

|

Provide details of any superannuation fund(s) held |

|

|

Super Guarantee |

$ 7,695 |

|

|

|

|

Subtotal |

$ 7,695 |

|

Assets Total |

$ 977,695 |

|

Liabilities |

Limit |

Amount outstanding |

Interest rate |

Repayment |

|

The current status of liability and its impact on their financial position |

|

|

|

|

|

Credit Card |

|

$ 55,000 |

17.75 % |

|

|

Mortgage value |

|

$235,000 |

8% |

|

|

Liabilities Total |

|

$ 290,000 |

|

|

|

Net Worth (Assets – Liabilities) |

$ 687,695 |

|

||

|

Income |

$ |

|

Income source, e.g., salary/wages, dividends, rental income, etc |

|

|

Income Salary (Including both of their salary) |

$ 203,000 |

|

Income Total |

$ 203,000 |

|

Expenses |

Amount (in dollars) |

|

Food and petrol |

34,000 |

|

Mortgage |

34,400 |

|

Other living expenses |

31,000 |

|

Home, car, and property insurance |

3,000 |

|

School fees |

20,000 |

|

Holidays |

13,000 |

|

Credit cards |

22,550 |

|

Total Expenses |

$157,950 |

|

Estimated Cash Surplus / (Deficit) per month |

$45050 |

Issues that are Potential for the Client

- One of the most significant aspects that have been observed for the couple is that they are left with only 45,050 dollars after meeting with the total expenditure on an annual basis. It was determined that after their retirement, they would need to have at least $ 49,000, and with the current surplus, they would still be under a deficit of $ 3,950on an annual basis.

Objectives

- To minimise the overall expenditures and manage the expenses so that they are able to save for the future.

- To keep safety for the children after their retirement from their service.

- To meet with the average need for dollar, which is $ 49,000 in order to live after retirement.

- To have a good amount of emergency funds after their service period.

- To recommend a proper investment method in order to increase the bank balance and secure the future.

- To have proper insurance for their health after their service of employment.

- They would have a proper investment by being a conservative investor and get no negative results.

Risk Profile

- Steven’s are having large expenses as compared to their income.

- The higher expenses would affect their future savings and livelihood, along with the education of the children.

- The negative results will be identified after they have been retired, and the sum would be $ 10,030 in total.

- There isa lesser number of defensive assets, and the weightageis also less, which will affect their savings.

- The fixed interest, along with the availability of cash, is also considerably less for them.

- They should have a lower risk concerning their growth as well as the earning capacity.

List of Assumptions

- The Stevens is to purchase a house and invest in the government bond with their savings.

- They are not investing in any cash flow.

- They are selling the inherited rental house at 20 per cent over the current market value.

- The new house will be purchased at $600,000, and the remaining amount will be used for repaying the credit card dues and the 17.5 per cent interest due on it.

- They have a higher risk of investing in cash flow, and the investment will be made on government bonds only.

- They are to be recommended with effective investment options at priority from the very beginning.

- They will be renting the new property, and the earnings from it will be used to safeguard their future after retirement.

List of Questions

- Was buying the new house effective towards your future gaols of financial stability?

- Was the financial burden significantly reduced by selling the low value house?

- Was buying the new house by selling the old house and rational decision?

Wealth Creation & Lifestyle Recommendations – Outside Superannuation

1. The goal [To Buy Another Houseby Selling the Inherited Rental House]1

Strategy Recommended

- It is recommended to Steven’s that they should buy a government bond at a fixed rate so that after retirement, they can earn by renting the place.

- They should sell the rental property they currently own as it has a very low return of 4 per cent.

- The government bond within Australia is paying a fixed rate 2.5 per centfor a tenyears’ time period.

- The surplus they have after the expenses should be saved until the retirement period is being met.

- After maturity, they would have a substantial amount of savings in order to provide proper education and meet with their yearly requirement.

The Overall Advantages of the Strategy

- Owning a house, which has a higher return rate, will provide better security for Steven’s.

- The chosen strategy will allow in maximising their savings

- The income from the government bond will also increase from this strategy

The Overall Disadvantages of the Strategy

- The surplus for each month will be used.

- Unable to sell the bonds before selling.

The calculation for Buying New House

Considering they are selling the inherited rental house at 20 per cent over the current value, they would have (570000+ (570000*20/100)) = 6,84,000. The new house will be purchased at $ 6,00,000 and the rest $ 84,000 would be used to repay the dues on the credit card as well as the 17.5% interest on the credit card.

Recommendations for Wealth Creation – Superannuation

The Goal is to Sort the Superannuation

Recommended Strategy

- They Should Invest around 70 per cent of the funds of superannuation for a longer time period thirty per cent should be invested in funds that are diversified(Refer to Appendix 1).

- Moving into assets that are more defensive would allow them to minimise the risk of facing the market volatility and recession in the economy.

- Moreover, diversified funds are less risky as compared to shares, and the losses are set off when profit is earned by another sector in the country.

Advantages of strategy [reasons why]

- The rate of interest is fixed for the bonds from the government and would allow them to take less risk as they have very fewer savings and are on their early and mid-forties.

- The diversified funds are more extensive and less risky as no one sector is being focused on specifically.

Disadvantages of strategy

- The rate of return is quite low as compared to the earning from shares.

- There are quite small returns from the funds that are diversified.

- The availability of the invested fund during an emergency is not an option.

Wealth Protection (Insurance) - Recommendations

- Life insurance

Life insurance policies provide the customers with the protection of wealth and savings. The policyholder and the insurer collaborates in a contract and signs it. The benefits of the insurance are written on the contract, and the payment is guaranteed by the insurer to the policyholder or the customer. There are individuals who are benefitted by the policy other than the policyholder. This signed contract promises to provide benefits to the dependents of the policyholders.Emily and Joel Stevens have faced a huge amount of expenditure in the past years and are unable to save money due to some issues. Life insurance is recommended to Joel and Emily as they have children, which can be called as dependencies. The children will be the beneficiaries of the policy only after the death of Emily and Joel. This policy is highly recommended to them according to me as the fees of schools, colleges are hiking every year, and the cost of higher studies is more than expected.

The main advantage of this policy is that the children will be able to survive if anything happens to Emily and Joel.

However, the disadvantage is that Joel and Emily will not be able to get the benefits of the policy.

- Total and permanent disability (TPD) insurance

- Total and permanent disability provides an insurance policy that ensures the customers with disabilities policies, which may happen in case of any loss of legs or eyes or any physical challenges. This policy is applicable to the individuals that work in risky or dangerous places and have life risks.

- This policy cannot be recommended to Joel and Emily according to my views.

- One of the prime advantages of this policy is that the affect6ed get a massive sum of money if he/she is medically diagnosed with issues of inability to work.

- However, the disadvantage is that this policy is only applicable to the individuals that have suffered permanent and total disability in the work process.

- Income Protection (IP) Insurance

- Income protection is a policy of insurance where the policyholder is obliged by the insurer specific facilities when he is unable to conduct his work in case of any illness or accident.

- I would recommend Joel and Emily to apply for this policy because they are seeking to protect their wealth and income, as they do not have much savings in their accounts even after earning a considerable amount of money.

- The advantage of this policy is that in case of any sickness that has happened to the children, they are able to gain benefits from this type of insurance.

- It also ensures the income of the policyholder if the person is not working due to some issues.

- Trauma Insurance

- Trauma insurance policy is also known as critical illness insurance that provides a massive sum of money to the policyholder to cover any emergency medical expenses.

- Financial needs are also covered up with this insurance in case of any critical injury or illness. I would recommend Emily and Joey this policy as they are getting old and may have any emergency issues in the future.

- There are many issues related to trauma, specifically intensive care or heart attacks, which are common these days, mostly in the middle age group. Such problems need a lump amount in healthcare, which is provided by this policy. This is the most crucial advantage of insurance.

- There is a disadvantage with this insurance that it can be only used in case of some serious illness like cancer or other life-threatening medical conditions

- Private Health Insurance

- Private health insurance is medical concealment applied if any policyholder is interested in taking private care at medical service. I would not like to recommend this to Emily and Joey as they need to save money at this point in time, and private services cost a huge sum of value.

- The advantages of this policy include admittance to private rooms, freedom of choice regarding doctors, and less time in getting services in the hospitals.

- The major disadvantage is that this policy is highly expensive and does not cover many factors of savings for the customers.

REFERENCES

Chen, Z. and Sakouba, I., (2020). Impact of the number of bonds on bond portfolio exposure to interest rate risk. International Journal of Finance & Economics.

Appendix 1 – Calculation Of The Future Value Of Government Bond

Evaluation of the Future value of Australian ten years government bonds that they will be investing in from their savings

Bond Rate of Australian 10 years government bond is 2.5%.

Consideringthat Stevens has $ 45,050(Total income minus expenses) to purchase bonds, the future value of bonds is given as follows:

Future Value =Present value* (1 + interest rate) ^Period

Amount = 45,050;

Interest rate = 2.5%

Period = 10 years government bond.

Future Value = 45,050* (1+0.025) ^10 = $57,664

Thus, they would be earning more than what was required for the future, which was $49,000 and by investing the 10 years Australian government bond, they would be earning $ 57,664.