Illustration Of Rio Tinto Financial Analysis Over Last Five Years

Question

Task:

Select a company that is currently listed on the ASX.

Write a Financial Analysis Report using an essay structure to interpret a company’s most recent

annual report.

Assessment Description

Students will write a Financial Analysis Report for a stakeholder (external investor or internal

manager) that interprets the annual report of an Australian company. The Report will clearly

state recommendations about the company’s suitability for share investment or internal

management. The company should be listed on the ASX.

Students will be assessed on the thoroughness of the financial analysis. Thoroughness requires

a logical justification of why financial and non-financial performance indicators are included in the

analysis. The analysis will be formally written to meet the expectations of a stakeholder.

The report is limited to 1000 words, plus or minus 10%, excluding title page and bibliography.

Answer

Executive Summary

The report illustrates about the Rio Tinto financial analysis which is the “Australian company” and provides the overview of its financial performance over the last five years. The financial position of "Rio Tinto Limited" has been improved over the years. The revenue of the company has increased, and it has reached its targeted sales as planned by the management of the company. The performance of the company is quite impressive, which can be seen in the financial statement of the company. It has been noted in the study of Rio Tinto financial analysis that the changes made in the management and strategies of the company are giving positive effects to the company.

Introduction

The present study is shedding light on the Rio Tinto financial analysis along with basic ratio analysis of the company. “Rio Tinto Limited” is an Australian company which is listed in the “Australian Securities Exchange” under top 30 companies. It is an “Anglo-Australian multinational metal and mining corporation”. It was founded in 1873 by “Hugh Matheson” who was a “Scottish industrialist”. The work of the company is to extracts minerals especially “aluminium”, “iron”, “ore”, “copper’, “uranium” and “diamonds”. The company has developed its operations in “refining of bauxite and iron ore. It is a multinational company and operating in 35 different countries with the help of the people. According to the revenue of the company that is 45.1 billion US Dollars, the company is the "third highest mining company in the world". The people easily purchase the shares of the company as they are listed online in "Australian Securities Exchange".

Rio Tinto financial analysis

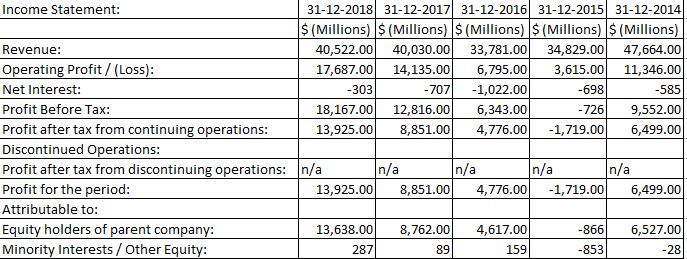

Its financial statement determines the financial position of the company. The financial statement is identified by "income and expenditure account", "statement of cash flows" and "balance sheet". These accounts show the annual report of the company. In this report, the analysis has been done for five recent years. The comparison of different years shows the amount of growth the company has made in these years (Bragg, 2018). The income statement of the company shows a profit over the last few years. Rio Tinto financial analysis indicates that the benefit for the company in 2018 is $13,925 million. This shows the growth that the company is doing by changing its way of working. The new marketing strategy is helping the company for its betterment. The company has made changes in the policy and management of the company's working. The positive effect of the work can be seen in the company’s balance sheet. The company has understood the customer’s perspective and working according to the needs of the customers. This has helped the company to become one of the largest companies in “Metal and Mining Corporation”. The study of Rio Tinto financial analysis demonstrates about the annual accounts of the company have given the information regarding the equity holders of the company which is also seen to be increased from 2017 to 2018 from $8851 million to $13638 million (Muda et al. 2018). The figures of the annual accounts show the growth that the company has upheld in recent years. (Referred to Appendix 1)

Figure 1: Income Statement

(Source: Excel)

How Rio Tinto financial analysis is impactful for improvement of revenue and earnings per share?

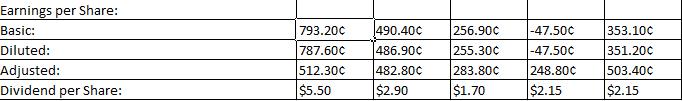

“Rio Tinto limited" has increased its revenue over the years. According to the Rio Tinto financial analysis, the sales of the company have doubled over the years, and due to which the income of the company has increased in the recent years like in 2016 it was $33781 million, 2017 it was $40,030 million, and in 2018 it was $40,522 million (Nazal, 2015). The figures for revenue can be seen, and it is noted that the company has made growth in terms of revenue. The new strategies and policies of the company are giving a good return to the company. As per the Rio Tinto financial analysis, the earning per share of the company has also increased due to the increasing profit of the company. The basic share per price in 2016 was 256.90¢, 2017 was 490.40¢ and in 2018 was 793.20¢. This shows the growth of the company as the shares of the company define the value of the company. The share price is growing in recent years and has predicted that it will become more in the upcoming years.

Figure 2: Earning Per Share

(Source: Excel)

Improvement of Management Structure and Ownership Structure

The company has improved its management and ownership structure which changes the structure of the company. The balance sheet of Rio Tinto financial analysis shows the growth that the company upholds after the new improvements in the company. The company strengthen its employees for the development of the company (Xuepei and Siqi, 2015). The employees are the primary utilisation of the company and competent employees will give good and better decisions that will help the company in its management skills. They try to connect with more people to understand the requirement and to make a better decision for the company. The company included two new items in its manufacturing that were bauxite and aluminium, which helps the company to strengthen its position in the market. After performing the Rio Tinto financial analysis, the improvement can be seen in the balance sheet of the company, which shows growth in the assets and liabilities of the company. The company has made the right decision can be calculated with the help of the Rio Tinto financial analysis of annuals accounts. (macrotrends.net, 2019)

Improvement of Strength of the Company Management

The company has worked on its strengths and proved that the company could do good business if they work correctly. The new strategies and planning of the company helped them to understand the market and the latest marketing strategies. As discussed in this report of Rio Tinto financial analysis, the company works on its plan, policies, organising, communication and teamwork, which allows them to understand the thinking of different qualified employees. This helps them to understand the new way through which the work can be processed. The unique strengths of the company are as follows:

- The company became a "global leader" in the extraction of "aluminium and copper ore".

- The company uses the latest technology for extraction.

- The company has more than 70,000 employees which help them to do them quickly.

- The company has made its brand image which is quite helpful for the company.

- The company “3rd largest company” in “iron ore”, “aluminium”, “diamonds” etc. (hl.co.uk, 2019)

Conclusion

This report states the financial position of "Rio Tinto Limited". The Rio Tinto financial analysis shows the strength of the company. The company is growing and doing good business in the market. Management of the company plays an important role in the performance of the company. The company changed its management and strategies, which leads to development for the company. The profits of the company in recent years show the growth of the company. The new strategies helped the company to increase its revenue. In this report, the financial analysis of the "Rio Tinto Limited" has been done. This shows that the right decision can make huge profits for the company. The share price of the company has also increased drastically due to the improved decision of the company. The strengths of the company have been discussed in this study of Rio Tinto financial analysis that has an impact on the financial position of the company.

Reference list

Books

Bragg, S.M., 2018. The Interpretation of Financial Statements. Rio Tinto financial analysis. AccountingTools, Incorporated.

Journals

Muda, I., Harahap, A.H., Ginting, S., Maksum, A. and Abubakar, E., 2018, March. Factors of quality of financial report of local government in Indonesia. In IOP Conference Series: Earth and Environmental Science (Vol. 126, No. 1, p. 012067). IOP Publishing.

Nazal, A.I., 2015. Financial Analysis Problems in Specialized Islamic Bank. International Review of Management and Business Research, 4(2), p.414.

Xuepei, L. and Siqi, C., 2015. Risk Hedging Strategies for Business Enterprises——A Case Study of Rio Tinto. International Journal of Business and Social Science, 6(5).

Websites

hl.co.uk, 2019, Rio Tinto financial analysis rio-tinto-plc-ordinary-10p/financial-statements-and-reports Available at: https://www.hl.co.uk/shares/shares-search-results/r/rio-tinto-plc-ordinary-10p/financial-statements-and-reports [Accessed on: 25.09.2019]

Online articles

macrotrends.net, 2019, rio-tinto/financial-ratios Available at: https://www.macrotrends.net/stocks/charts/RIO/rio-tinto/financial-ratios [Accessed on: 28.09.2019]

Appendices

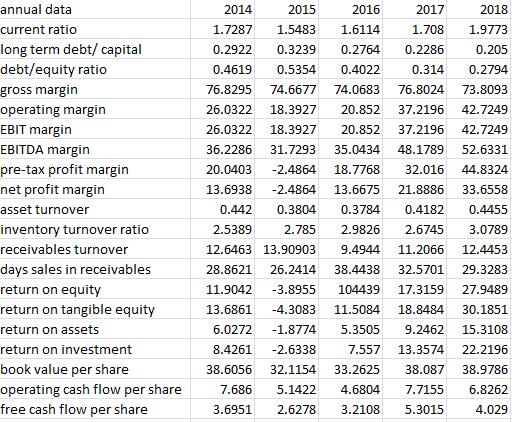

Appendix 1: Ratio Analysis

(Source: Excel)