International Finance Assignment: Impact of Financial Developments on PayPal

Question

Task: Choose a Multinational Enterprise (MNE) listed on an internationally recognised Stock Exchange (including for example, London, Dublin, New York or Paris). You are required to prepare an international finance assignment addressing the following points:

a. Critically discuss two recent developments in the international financial environment which appear to have impacted on your chosen company’s recent performance and development. Analyse how these two developments are likely to impact on the company in the near future.

b. Discuss the following key elements of the MNE’s international financial and/or risk management strategy (and how they appear to have affected the financial performance of your chosen company):

- Sources of finance

- Dividend policy

c. With reference to your chosen Multinational Enterprise (and using the most recent annual report published), analyse the financial performance (in terms of profitability, liquidity, efficiency and investment) of the company in the two most recent consecutive financial periods (e.g. 2018/19 or 2019/20) using 8 different accounting ratios (prior year comparative figures will be available in the annual report).

Answer

Introduction

This particular international finance assignment would be based on the technological payment company, PayPal and its recent business developments affecting the organisational performance. So the report would explore two significant financial developments affecting its productivity and run a discussion on international financial or risk strategy adopted by PayPal. Then the report would conduct a financial ratio analysis of the organisation over a period of two years – 2019 and 2018. The report would be based on the digital financial services organisation PayPal Holdings, Inc.an innovation to operate in the global economy.

The organisation is known across the spectrum for its global online payment arrangements facilitating the online transfer of money. PayPal offers its services worldwide and is a subsidiary of another technological organisation, eBay. The American company is headquartered in California and listed in the NASDAQ in 2002 with a market capitalisation of $1.5 billion. PayPal was ranked 204th in the Fortune 500 category for being the largest US organisation in terms of revenue worth $17.72 billion in 2019(PayPal, 2020). The organisation has 325 million active users across 200 countries globally dealing in more than 100 currencies.

Recent developments in the international financial environment

In this section, a discussion would be run on certain developments that are supposed to affect the organisational performance of PayPal in the forthcoming times. They are as follows:

PayPal could trade crypto-currencies using its platform –

PayPal added another feather to its cap by including cryptocurrencies for trading using its platform. The customers would be able to buy cryptocurrency directly using their PayPal account. The organisation would facilitate the weekly purchase of cryptocurrencies worth $20,000 up from the initial limit of $10,000. Currently, there are 26 million merchants on the PayPal platform using bitcoins and other sorts of virtual coins. This sort of arrangement would supposedly benefit PayPal users to process online dealings, most of which are international. The organisation having 346 million active accounts globally processing transactions worth $222 billion in the 2nd quarter of 2020-21 having the potentiality to enhance its business activities(Reuters, 2020).

PayPal would not charge any additional fee to hold

cryptocurrencies for the time being inspiring the users to use the platform for more such dealings. This particular news was inspiring to the market as well as its share price increased by 4%(Reuters, 2020). This particular move would enable the cryptocurrencies to gain ground internationally enhancing the might of PayPal as a recognised platform to have the authority to deal in virtual currencies. So this activity would increase the business activities of PayPal over its competitors like Payoneer, Venmo and gain a strong ground in its financials as hinted by the rise in its share price.

PayPal is getting used for money laundering –

The criminals are using the PayPal platform to launder the money meant for coronavirus relief. The authorities had recently noticed that the money meant for CARES Act and COVID-related stimulus are diverted to popular platforms like PayPal and have discovered 700 cases like this. This kind of allegation is not helping PayPalto run its business in the market as any sorts of unforeseen involvement would lead to a bad name for the organisation in the competitive market. The Secret Service authorities found that the stimulus for Unemployment Insurance Relief or the Paycheck Protection Program worth $240 million is laundered using such platforms (CNBC, 2020).

This sort of illegal activities if conducted using the PayPal platform for a while attracting sanctions by the authorities. It would indicate a black spot on the business activities of the company and limit its activity internationally. So PayPal needs a strong system to prohibit such kinds of illegal activities and notify the authorities in case of any suspicious dealings. It is because PayPal’s alleged involvement in such fraudulent activities could attract a massive penalty from the authorities and restrict its business expansion like cryptocurrency dealings affecting the business potentialities.

International financial or risk management strategy

In this section, the discussion would explore the plausible financial or risk management strategy undertaken by PayPal management affecting its performance in terms of its funding and dividend policies.

Source of finance

PayPal source its fund from common stocks, buying treasury stocks, tax withholdings besides having debts. The organisation sourced funds worth $3.7 billion in 2019 to run its business operations(Investor.pypl, 2020). A hefty amount of $5.5 billion was sourced by issuing long-term debts as fixed rate notes and borrowings as per the Amended Credit Agreement. The cash inflow of $2.5 billion was used to settle debts while $1.4 billion was used to repurchase stocks from the market.It is notable to mention that PayPal experienced a higher instance of unused credits, say $3.1 billion in 2019 against $1.8 billion in 2018.

But this kind of arrangement runs invariable risks owing to the fluctuations in the level of customer transactions in a market filled with competitors. PayPal has the due inclination to debt instruments increasing its debt obligations that the organisation needs to pay off in due time. The interest rates often exploit the gravity of the situation posing a burden to the company’s profitability for its timely payment(Alexander & Britton, 2017). In such a scenario, it would be better for PayPal to turn its attention to equity financing though the same is subjected to market conditions and the COVID situation has further intensified the matter.

Dividend policy

The right to decide and declare dividends stay with the Board of Directors of PayPal but to date, the organisation has never declared any sort of dividend to its shareholders. As per the NASDAQ estimate, PayPal has around 3,553 shareholders but it follows a strict policy not to declare cash dividends and has no such intention in the forthcoming future as well(Investor.pypl, 2020). Generally, declaring dividends help the company to gain ground in the competitive market to get the attention of the potential stockholders. But PayPal foresees adifferent approach by catering to the long-term wealth needs of the shareholders rather than the short-term needs of the dividends. So PayPal pursues value investing for its investors as its various business achievements like the ability to trade, hold, and sell cryptocurrencies soared the stock price by 4%(Watson & Head, 2016).

Financial performance of PayPal

The financial performance of PayPal would be evaluated on various parameters like profitability, liquidity, efficiency, and investment using the financial ratios for the consecutive periods of 2019 and 2018.

Profitability:

The profitability aspect of PayPal is represented by operating profit margin and return on equity.

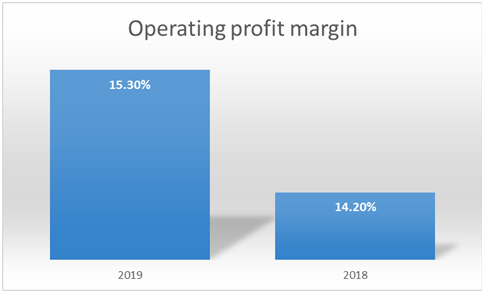

Operating profit margin –

Operating profit margin = Operating income / Sales revenue

The graph above shows the operating profit margin for PayPal having a figure of 14.20% in 2018 which increased to 15.30% in 2019. It shows that PayPal has been able to exploit its business operations well to extract an effective profitability to remain relevant in the prevailing marketplace(Kim, et al., 2018). The improvement in the operating margin has been plausible owing to an increase in the sales revenue of the company along with control of the operating expenses, say the restricting charges. PayPal is instrumental in reducing the restructuring charges from $309 million in 2018 to $71 million in 2019 leading to improvement in its operating profitability.

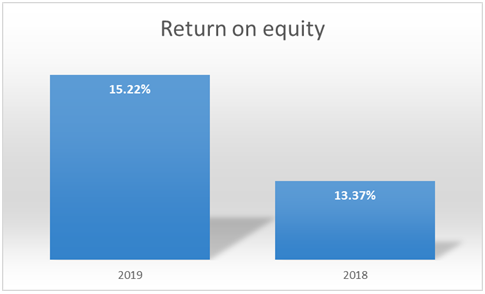

Return on equity –

Return on equity (ROE) = Net income / Average equity

ROE is the financial determinant showing the extent of profitability derived of the net profit allocated for the equity shareholders providing capital to run the business (Huff, 2017). PayPal has gained an impressive outcome as its ROE increased from 13.37% in 2018 to 15.22% in 2019.It indicates that the organisation has earned better profits in the current year to be distributed among its shareholders. ROE is a significant determinant as it indicates the capability of the company to deliver profit to the investors and generate wealth for them fulfilling the ultimate goal(Dyck, et al., 2019).

Liquidity:

Liquidity is an important aspect in the corporate sphere of PayPal to be determined in terms of current ratio and cash ratio.

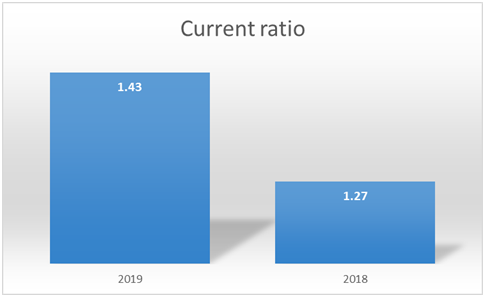

Current ratio –

Current ratio determines the capability of the organisation to meet its obligations that are due to mature within a short stint, say within a year (Barton & Wiseman, 2014). Generally, it is the norm to have an ideal current ratio of ‘2’ but in case of PayPal,it was 1.27 in 2018 while it became 1.43in 2019. The figures indicate that the organisation has adequate resources to meet its obligations within the due period and strives to exploit its resources to meet the business needs rather than keeping it ideal. Therefore, the liquidity of PayPal is at a safe position to save the company from the bankruptcy risk(Jones & Temouri, 2016).

Current ratio = Current assets / Current liabilities

Cash ratio –

Cash ratio = Cash resources / Current liabilities

Cash ratio pose for a conservative approach to liquidity determining the capability of the firm to meet its short-term obligations using the cash resources and cash equivalents like marketable securities(Bennedsen & Zeume, 2017). Ideally there is no yardstick for cash ratio but organisations assume a figure of 0.5 to 1 as a suitable one. In this case, PayPal has a cash ratio of 0.29 and 0.27 in 2018 and 2019 respectively. It shows that the firm has the requisite resources to meet its immediate obligations but it would be better to have a higher figure in this category to avoid the risk of bankruptcy.

Efficiency:

The efficiency element of PayPal would be represented through accounts receivable in days and accounts payable in days.

Accounts receivable (days) –

Accounts receivable (days) = (Average receivables / Credit sales) x 365 days

Accounts receivable in days show the number of days that the organisation takes to collect its due from the market determining its efficiency (Lins, et al., 2017). PayPal had accounts receivable of 7.39 days in 2018 and 7.68 days in 2019 indicating that the firm takes approximately a week to collect its receivable from the market. Generally a period of 30 days is considered suitable for the purpose but PayPal has an extraordinary feat in collecting its dues within a short time. It shows the efficiency of the collection department of the organisation in having the dues through purposeful negotiations insisting the debtors to pay off timely(Dyck, et al., 2019).

Accounts payable (days) –

Accounts payable (days) = (Average payables / Credit purchases) x 365 days

Accounts payable in days denote the number of days the organisation takes to pay off the suppliers and generally the company tends to delay the payment to exploit it in its favour(Huff, 2017). PayPal has accounts payable for 7.74 days in 2018 and 6.23 days in 2019 indicating that it does not hold the payment for long rather pay off the creditors and suppliers instantly. This sort of figure shows that the PayPal does not possess corporate policy to hold the payment and clear it as early as possible(Jones & Temouri, 2016). It is useful to develop a good business relationship with the creditors. Investments:

Investments ratio would be illustrated with the instance of earnings per share and price-to-earnings ratio of PayPal.

Earnings per share –

Earnings per share or EPS denotes the organisational profitability in terms of the number of outstanding stocks in the market against the net profit earned(Kim, et al., 2018). EPS of PayPal stands at $1.74 in 2018 which increased to $2.09 in 2019 indicating that with time the capability of the company is increasing duly. It is a significant determinant for the company and the investors would be happy to see that the EPS is increasing with time(Lins, et al., 2017). PayPal is gradually extending its wing in the international market and its increasing EPS would be promising to get attention of the existing and potential investors to gain suitable funding.

EPS = Net income / Total number of shares outstanding in the market

Price-to-earnings ratio –

Price-to-earnings ratio = Share price / EPS

Price-to-earnings ratio or P/E ratio stands for valuation of the stock indicating its potentiality to deliver in the long run (Alexander & Britton, 2017). The P/E ratio of PayPal increased from 47.85 in 2018 to 51.66 in 2019 showing the massive potentiality that the organisation possess in the current scenario. The P/E ratio is highly favourable tending a good return for the investors providing them the requisite inspiration to buy the stocks for extracting a greater value in the forthcoming times(Dyck, et al., 2019).

Discussion on financial performance

The financial performance of PayPal in recent times has been phenomenal as depicted from its profitability, efficiency, and investment ratios. The profitability aspect shows that both the parameters like operating profit margin and ROE increased due to betterment of its revenue and ability to control the operating costs(Lins, et al., 2017). It played in favour of PayPal to have a greater revenue and the future looks brighter as it would be exploiting more business opportunities.

The liquidity aspect shows that though the figures are way below the industry yardstick but the organisation has adequate resources to meet its obligations and keep the risk of bankruptcy at bay(Barton & Wiseman, 2014). The liquidity ratios of current ratio and cash ratio bears the testimony that PayPal possess the requisite resources to meet its short-term obligations.

The efficiency ratios represented by the accounts receivable and accounts payable indicate that PayPal has the requisite efficiency to collect receivables from the market and pay the suppliers before the due date. The ratios show that such sort of arrangements facilitate a stronger business relationship with its respective debtors and creditors tending for more business in the upcoming future.

The investment ratios illustrated by the EPS and the P/E ratio show the organisational potentiality to deliver a better return in the near future. It indicates that PayPal has a strong potentiality to perform in the near future and the investors associated with it would be highly benefitted of it.

Conclusion

The financial report on PayPal indicates that the organisation has due opportunities to explore in the international report. Events like opportunity to trade, sell, and hold cryptocurrencies on its platform would be a game-changing proposition adding more users and business to its account. But PayPal could be a victim of money laundering shattering its exponential growth tending for a higher level of security. The organisation has vivid source of funding, it primarily depends on debt funding followed by equity financing. PayPal is known for its financial performance but does not believes in the philosophy of delivering dividends to the investors rather provide a strong performance enabling the shareholders to strengthen their portfolio. The financials of PayPal is quite strong depicting its potentiality to establish a strong business sequence and facilitates the business scope suitably.

References

Alexander, D. & Britton, A., 2017. International financial reporting and analysis. 7th ed. London: Cengage.

Barton, D. & Wiseman, M., 2014. Focusing capital on the long term. Harvard Business Review, 92(1/2), pp. 44-51.

Bennedsen, M. & Zeume, S., 2017. Corporate tax havens and transparency. The Review of Financial Studies, 31(4), pp. 1221-1264.

CNBC, 2020. Criminals launder coronavirus relief money, exploit victims through popular apps. [Online]

Available at: https://www.cnbc.com/2020/11/18/criminals-launder-coronavirus-relief-money-exploit-victims-through-popular-apps.html [Accessed 18 November 2020].

Dyck, A., Lins, K., Roth, L. & Wagner, H., 2019. Do institutional investors drive corporate social responsibility International evidence. Journal of Financial Economics, 131(3), pp. 693-714.

Huff, A., 2017. A day in the books: CFOs share financial strategies. Commercial Carrier Journal, 174(8), p. 35.

Investor.pypl, 2020. PayPal Holdings, Inc. - Financials - Annual Reports. [Online]

Available at: https://investor.pypl.com/financials/annual-reports/default.aspx [Accessed 18 November 2020].

Jones, C. & Temouri, Y., 2016. The determinants of tax haven FDI. Journal of world Business, 51(2), pp. 237-250.

Kim, K., Kim, M. & Qian, C., 2018. Effects of corporate social responsibility on corporate financial performance: A competitive-action perspective. Journal of Management, 44(3), pp. 1097-1118.

Lins, K., Servaes, H. & Tamayo, A., 2017. Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. The Journal of Finance, 72(4), pp. 1785-1824.

PayPal, 2020. PayPal About - Home. [Online] Available at: https://www.paypal.com/in/webapps/mpp/about [Accessed 18 November 2020].

Reuters, 2020. PayPal to open up network to cryptocurrencies. [Online]

Available at: https://www.thehindu.com/sci-tech/technology/paypal-to-open-up-network-to-cryptocurrencies/article32915118.ece [Accessed 18 November 2020].

Watson, D. & Head, A., 2016. Corporate finance. 7th ed. New York: Pearson.

Appendix