International Finance Assignment: Impact of Recent Developments on Infosys

Question

Task

You are required to prepare/submit an individual report on international finance assignment discussing the following:

Choose a Multinational Enterprise (MNE) listed on an internationally recognised Stock Exchange (including for example, London, Dublin, New York or Paris). You are required to:

- ritically discuss two recent developments in the international financial environment which appear to have impacted on your chosen company’s recent performance and development. Analyse how these two developments are likely to impact on the company in the near future.

- iscuss the following key elements of the MNE’s international financial and/or risk management strategy (and how they appear to have affected the financial performance of your chosen company):

- Sources of finance

- Dividend policy

- With reference to your chosen Multinational Enterprise (and using the most recent annual report published), analyse the financial performance (in terms of profitability, liquidity, efficiency and investment) of the company in the two most recent consecutive financial periods (e.g. 2018/19 or 2019/20,) using 8 different accounting ratios (prior year comparative figures will be available in the annual report).

Answer

Introduction

In this report on international finance assignment, we are going to discuss about the financial results and effect on strategy of the company Infosys due to recent developments in the international financial environment and their risk management policy.

Infosys Limited is a company operating in the sector of Information Technology having its headquarters in Bangalore, Karnataka, India. The company provides variety of services like information technology and outsourcing, business consulting and managerial services worldwide. The company was incorporated about 40 years ago in the year 1981by seven engineers, namely N.R. Narayan Murthy, NandanNilekani, S. Gopalkrishnan, S.D. Shibulal, K. Dinesh, N.S. Raghavan and Ashok Arora. It was initially incorporated in Pune on 2 July, 1981 and then relocated to Bangalore in the year 1983(Infosys Limited, 2018). The company is listed on various stock exchanges like Bombay Stock Exchange (BSE: 500209), National Stock Exchange (NSE: INFY), New York Stock Exchange (NYSE:INFY). It is also a constituent of BSE SENSEX and NSE NIFTY 50. The company has three major divisions: Infosys BPM, EdgeVerve Systems and Infosys Consulting. The most famous product of the company is Finacle software which provides universal banking solutions to both retail and corporate banking modules. It has more than 82 sales and marketing offices and more than 123 development centers worldwide. The company made a profit of rupees 19,423 in 2021 and rupees 16,639 in the year 2020.

Section A: Recent Developments and Impacts

Infosys is a global leader providing digital services and consulting that would lead to the base and growth of next generation. The information technology industry is highly volatile and competitive; a company needs to continuously update software, products, services as per the new trends and requirements(Infosys, 2021). The research and development departments have to remain on their toe to find and invent new opportunities that can ease the way of conducting business and provide better solutions to clients. A small invention or new technology adopted or discovered by competitor may dive the customer flow.

Development One: Digitization in Banking Sector:

Recently due to the pandemic digital technologies like artificial intelligence and machine learning have become a major part of industries and day to day life of common people. Thus banking sectors will prioritize digitization in all possible areas to serve their customers with convenience. Major Banks have started adopting Fintech software to fit in to digital strategy and as the environment is of collaboration data protection is the primary objective.

Thus, the company is facing a challenge in formulation of such Universal API that can harmonise different systems and make the operations at ease both for banks and customers (Infosys, 2021). The company needs to upgrade its banking software Finacle to meet the current and future challenges.

Development Two: Hybrid Work Environment and Data Privacy:

As the future of work is hybrid the company is trying to combat the challenges being faced by its clients worldwide to reduce the dependency of paper work, offline payments, classes, meetings, etc. Nowadays, everything has to be available on a digital platform thus, the risk of data loss has also increased in order to mitigate such risks the company needs to develop software that can provide every service with more privacy and highest level of security, it is another challenge that the company is trying to deal. As the market is very competitive the company has to develop features such security features else they may lose their existing clients even.

Section B: Sources of Finance and Risk Management

The company Infosys maintains a dedicated Risk management Committee which works on formulating polices, providing solutions to decrease vulnerability of the company. Recently the committee formed a Cyber Security Committee with three of its member dedicated to mitigate risks and preparedness related to cyber security.The systematic and proactive identification of risks, and mitigation by the committee enables the organization to boost performance with effective and timely decision-making. The committee takes strategic decision after careful consideration of all types of risk factors like primary risks, consequential risks, secondary risks and residual risks. The ERM function helps in effective allocation of resource through structured assessment of qualitative and quantitative risk impact and prioritization based on company’s risk appetite.

Sources of Finance: External sources of finance are more risky as they bring along fixed obligations that are to be paid by the company timely otherwise they would be termed as defaulter and the assets of the company which are kept as collateral needs to be sold off. Whereas, raising funds through internal sources like equity share capital or using funds remaining in retained earnings or other free reserves are associated with zero risk and thus, should be more preferred as a source of finance as they not attach any fixed obligation or charge. As the company operates in a sector of information technology list minimization is its primary objective and thus it has to develop strategy of raising finance through such sources which will offer least risk and thus, the company is more reliant on internal funds than external sources.

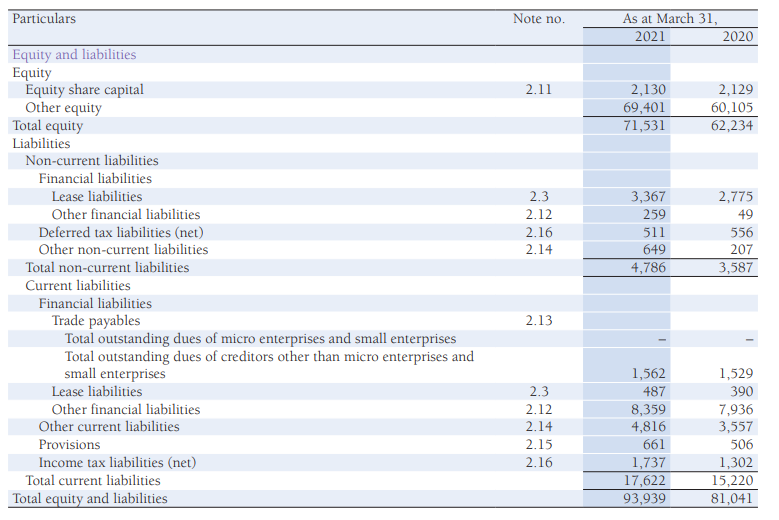

The bifurcation of sources of finance used by the company is as follows:

Source : Annual Report 2021

Equity: The total Equity was rupees 62,234 in 2020 which rose to rupees 71,531 in 2021 as the company issued fresh shares.

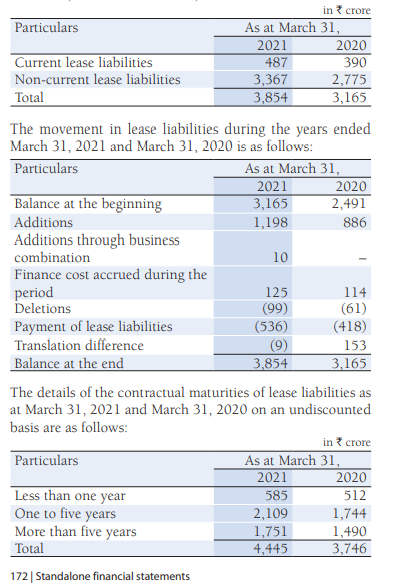

Debt: The total long term financial liabilities were rupees 2,824 in 2020 which rose to 3,626 in 2021as the company added a lease liability worth 1,198 crore to expand its business operations.

Source : Annual Report 2021

The company clearly relies more on equity than on debts, but it is gradually increasing its debt components to enjoy benefit of leverage like tax shield.

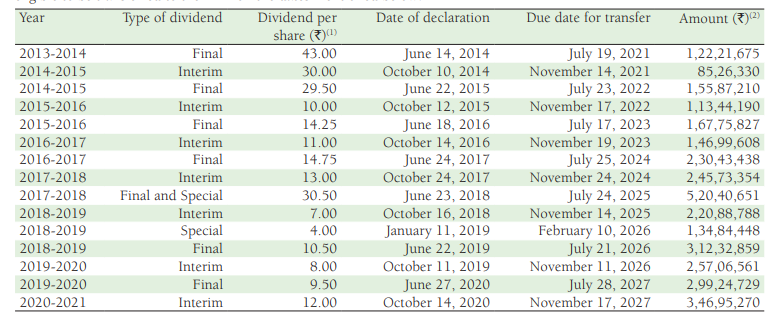

Dividend Policy: A company which declares regular dividend is considered less risky by prospective investors as they believe they would be getting a steady flow of income from their investment in the company and thus, such companies earn goodwill in the market. Whereas, companies who abstain from paying dividends are considered risky as the investors think that the company is unable to generate profit from their operations or do not possess sufficient cash and cash equivalents which would result in liquidation of the company in near future. Thus, Infosys has been paying dividends regularly to satisfy its existing shareholders and attract the potential investors by offering higher returns in form of dividends.

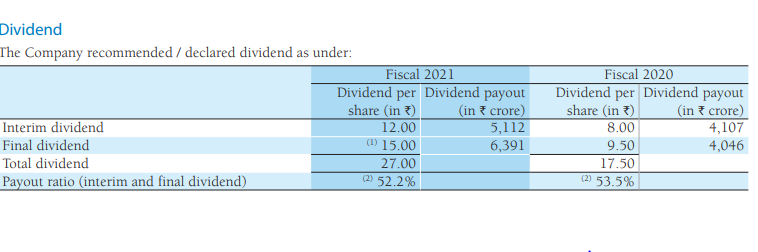

Source : Annual Report 2021

- The Current year dividend paid by the company is rupee 12.50 per share.

- It was declared at a growth of 26.32% as compared to last year.

Source : Annual Report 2021

The company falls the policy of Constant Dividend Payout; last year in 2020 it paid out 53.5% of its earnings and in the year 2021 it paid out 52.2% of its earnings.

Section C: Ratio Analysis

To ascertain the financial health of a company various tools are used to compare their performance with the last year performance or with other companies in the same sector. To analyze the financial performance first we need to collect data sources and then decide which metric to use based on the availability of resources to performance the analysis. Here, to evaluate the financial health of the company Infosys we have chosen the method of Ratio Analysis.

Ratios serves as a medium that help a company to evaluate, plan and control the performance of a company. We can calculate different variety of ratios as per the need of the users and perform a time-series comparison to take decisions. Ratios even help us to understand the relationship between different line items of the balance sheet – how they affect each other. Such information are vital both for internal and external users of financial statements.

We have eight ratios in five different categories their analysis is a follows:

|

|

|

|

2021 |

2020 |

|

Profitability |

||||

|

Return on Capital Employed |

Operating Profit (PBIT) x 100 |

Operating profit (Earnings from Operations) |

26,823 |

22,177 |

|

Total Assets |

1,08,386 |

92,768 |

||

|

Current liabilities |

23,865 |

20,856 |

||

|

|

ROCE |

31.74% |

30.84% |

|

|

|

|

|

|

|

|

Gross profit margin |

Gross Profit x 100 |

Gross profit |

26,628 |

22,007 |

|

Total Revenue |

1,02,673 |

93,594 |

||

|

|

GPM |

25.9% |

23.5% |

|

Profitability ratios assist the management of the company to plan their sales and production budget so that they can reduce cost of sales and increase their profit margin. Profitability ratios are calculated in two ways by estimating profit margin and return on funds invested (Allad and Maisuria, 2015).

Return on Capital Employed: This ratio is used to calculate the percentage of return served by the company to its capital providers. Any potential investor refers to this ratio before making any decision regarding investing in a company. The return on capital employed of Infosys has increased in the year 2021 to 31.74% as compared to 30.84% in the year 2020. This increase was possible as the operating profit increased from 22,177 crores to 26,823 crores in the year 2021(Infosys, 2021a). The company has efficiently reduced its operating expenses and the sales revenue also increased resulting in an over increase of the return on capital employed. The total capital employed in the company has also increased as the amount of net assets increased from 71,912 crores to 84,521 crores. The company made a few purchases of Property, Plant and Equipment and Right to Use Assets in the year 2021.

Gross Profit Margin: This ratio tells us about the profit earning capacity of a business through its core operations. This ratio is very important for mangers to decide on budget of sakes and production. The Gross Profit Margin of Infosys increased from 23.5% in the year 2020 to 25.9% in the year 2021(Infosys, 2021a). As the gross profit of the company increased from 22,007 crores to 26,628 crores in 2021 due to increase in sales the overall gross profit margin also increased. In the year 2021 though the total cost of sales increased due to increased cost of software packages and others, employee benefit expenses, cost of technical contractors but the revenue increased by a higher margin covering all the expenses and leading to a higher profit margin.

|

Liquidity Ratio |

||||

|

Current Ratio |

Current Asset |

Current Asset |

60,733 |

54,576 |

|

Current Liabilities |

23,865 |

20,856 |

||

|

|

Current ratio |

2.54 |

2.62 |

|

Liquidity Ratios are used to assess the short term solvency position of a company. These ratios tells us about the company’s ability to meet its working capital requirement through rotation of short term funds and not relying on long term or any external sources to run their daily operations(Lalithchandra and Rajendhiran, 2021).

Current ratio: This ratio measures whether the company has sufficient amount of liquid funds to meet its current obligations. If the current assets are twice more than the amount of current liabilities than it is said to be an ideal position as it indicates that the company can pay off its current liabilities and still has funds to grab any new opportunities or meet contingent liabilities and expenses. Infosys had a current ratio of 2.62 times in the year 2020 which decreased slightly to2.54 times in 2021(Infosys, 2021a). The company has maintained sufficient amount of current assets in both the years which depicts its strong short term financial position. But, as the company has large amount of ideal cash and cash equivalents it should try to invest them in interest earning opportunities to generate short term income. As except the short term investments all the current assets have increased in the year 2021 the company should plan to invests more in profit earning opportunities as there is large amount of ideal cash with the company.

|

Efficiency Ratios |

||||

|

Receivables turnover days |

Receivables x 365 days |

Average receivables |

18890.5 |

16657 |

|

Total Revenue |

1,02,673 |

93,594 |

||

|

Recv Turnover days |

67.2 |

65.0 |

||

|

|

|

|

|

|

|

Asset Turnover |

Revenue |

Revenue |

102673.0 |

93594.0 |

|

Total Assets |

108386.0 |

92768.0 |

||

|

Asset Turnover days |

0.9 |

1.0 |

||

Efficiency Ratios are the ratios which indicate how efficiently is the operating cycle of a company is being managed. Do they meet their operating requirements by internally generated funds of has to depend on external sources. These ratios also indicate the efficiency of a company in using its assets and generating revenue for the company.

Receivable Turnover Ratio: This ratio is used to measure how quickly is the company able to realize its debtors and decrease the chance of bad debts. This ratio serves as a guiding light for the company to make provisions for bad debts and boost up their debt collection process so that current liabilities can be paid off conveniently. The receivable turnover ratio of the company is quite which means it takes quite a long period to collect funds from its debtors. The ratio was 65 days in the year 2020 which increased to 67 days in the year 2021(Infosys, 2021a). Generally a period of 30 days is given by creditors to settle their payment and enjoy discounts thus, if the company wants to enjoy such discount its should focus on reducing its receivable turnover to below 30 days and as also thereby reduce the risk of bad debts.

Asset Turnover Ratio: This ratio indicates the efficiency of the company in terms of using its assets. The higher the ratio the better it is as it will indicate that the company is generating higher revenue by efficiently using it assets. The asset turnover ratio of the company has decreased from 1 time to 0.9 times in the year 2021 reason being that the total assets of the company has increased by a larger margin than its revenue in the year 2021(Infosys, 2021a). Thus, we can say that the company is using its resources in an optimum manner but should also try to improve the ratio by employing the assets more efficiently.

|

Gearing Ratios

|

||||

|

Interest Coverage |

Operating Profit (Earnings from Operations) |

Operating profit |

26,823 |

22,177 |

|

Interest on loan |

195 |

170 |

||

|

|

Interest coverage ratio |

137.55 |

130.45 |

|

|

|

|

|

|

|

|

Gearing Ratio |

Non-current liabilities |

Non-current Liabilities |

7,739 |

6068 |

|

Equity |

76,782 |

65,844 |

||

|

Non-current Liabilities |

7,739 |

6068 |

||

|

|

Gearing ratio |

0.09 |

0.08 |

|

Gearing Ratios are used to understand the leverage position in a company. These ratios helps to understand whether the company is more reliant on debts or internally generated funds like Equity, Retained earnings ,etc, to source its assets and expansion projects. These ratios serve as risk indicators for a company, as a company with higher portion of debts in its capital employed is said to be highly risky as at the time of liquidation all its assets would be charged against repayments of debts and the profits will be absorbed by fixed interest obligations.

Interest Coverage Ratio: This ratio indicates whether the company will be able to pay off its finance cost with the profits earned by the company. Infosys has shown a positive increase in its interest coverage as the ratio was 130.45 times in the year 2020 but increased to 137.55 times in the year 2021. It means that the company is earning sufficient profits from operations to meet its fixed interest obligations(Infosys, 2021a).

Gearing Ratio: This ratio informs the user of financial statement whether the company is more debt oriented or equity oriented. An investor would always chose to look at this ratio before investing in a company to know whether his funds would be realized at the time of liquidation and a bank or financial institution also looks at this ratio before imparting loan to a company to perform credit rating. The Gearing ratio of Infosys is quite low as the company is dependent more on its internal sources of finance than external sources the company’s Equity of the company is ten times higher than the non-current liabilities (constituting loans and lease liabilities). Thus, we may say that the risk associated with the company is quite low.

|

Investment Ratios |

||||

|

Earnings Per Share |

Earnings |

Net Profit |

19423.0 |

16639.0 |

|

Total No. of Equity Shares |

424.2 |

425.8 |

||

|

EPS |

45.8 |

39.1 |

||

Investments Ratios helps the company to attract potential investors as highest the investment ratios more will be the goodwill of the company and the investors will be attracted to invest in such companies. These ratios indicate the returns earned by the company for its present shareholders and also serve as a medium for valuation of the company.

Earnings per Share: This ratio indicate the amount of profit earned by the company for its shareholders. Higher the earnings per share higher can be the value or price per share of the company if other factors are also positive and favorable. The Earnings per Share of the company Infosys has increased from 39.1 in the year 2020 to 45.8 in the year 2021 as the company bought back shares worth 6,260 crore in the year 2021 and also the net profits of the company has increased by a large amount(Infosys, 2021a). This increase is a positive indicator of increasing worth of the company’s share in market.

Conclusion

From our above analysis we can say that Infosys is a not only a global leader in terms of providing services but also possess a very strong financial base which is ideal for a company to grow and expand its endeavors.

References

Allad, I. and Maisuria, Dr.M.H.M. (2015). “Ratio Analysis” An Accounting Technique of Analysis and Interpretation of Financial Statements IDRISH ALLAD DR. MAHENDRA H. MAISURIA. International Journal of Research in Humanities & Social Sciences, [online] 3(2). Available at: http://www.raijmr.com/ijrhs/wp-content/uploads/2017/11/IJRHS_2015_vol03_issue_02_11.pdf.

Infosys (2021). Infosys Press Releases | Infosys Latest News | Newsroom. [online] www.infosys.com. International finance assignment Available at: https://www.infosys.com/newsroom/press-releases.html [Accessed 12 Nov. 2021].

Infosys (2021a). Index Overview and notes to the financial statements 1. Overview. [online] Available at: https://www.infosys.com/investors/reports-filings/quarterly-results/2020-2021/q4/documents/standalone/sa-fy21-q4-and-12m-finstatement.pdf [Accessed 12 Nov. 2021].

Infosys Limited (2018). Infosys - Company History & Defining Milestones | About Us. [online] Infosys.com. Available at: https://www.infosys.com/about/history.html.

Lalithchandra, B.N. and Rajendhiran, Dr.N. (2021). Liquidity Ratio: An Important Financial Metrics. Turkish Journal of Computer and Mathematics Education (TURCOMAT), [online] 12(2), pp.1113–1114. Available at: https://turcomat.org/index.php/turkbilmat/article/view/1129.